Credibility5

On-boarding process5

Large accounts4

Fees4

User experience and design5

Customer service5

But does ease of use come at the cost of control? And should you be handing over your portfolio to a robo-advisor or would a self-directed approach serve you better in the long run?

The pros are obvious — zero commission fees, a modern interface and effortless investing.

But what are the downsides of simplified investing? Less flexibility is on this list.

Automated rebalancing works well for passive investors, but active investors may find better returns elsewhere.

On the flip side, Wealthsimple may lack some of the features of a traditional brokerage, but its simplicity is exactly why many Canadians prefer it.

So here’s the real question: Is it time to switch or should you double down and keep Wealthsimple as your financial hub?

| Get started with Wealthsimple's robo advisor | I prefer self-directing my investments |

|---|---|

| Visit Wealthsimple managed investing | Visit Wealthsimple self-directed investing |

Who is Wealthsimple is best for?

Wealthsimple managed investing (formerly Wealthsimple Invest) is built for beginner investors and those who prefer a hands-off approach to investing. If you want a "set it and forget it" portfolio that automatically rebalances and adjusts to market changes, this is a great fit.

Related read: top rated robo advisors

The platform simplifies long-term investing, making it easy to open a TFSA, RRSP or FHSA and start growing your wealth without needing deep financial knowledge.

However, if you're someone who likes full control over asset allocation, stock selection or tax strategies, you may find Wealthsimple's robo-advisor a bit too restrictive.

For DIY investors, Wealthsimple self-directed investing (formerly Wealthsimple Trade) is an easy and zero-commission way to buy and sell stocks and ETFs. The platform is straightforward and mobile-first, making it ideal for those who want to invest without worrying about trading fees.

Related read: Commission-free trading platforms in Canada

The ability to buy fractional shares is a huge plus, especially for those looking to own big-name stocks with smaller amounts of money. That said, lack of advanced tools and high foreign exchange fees mean it’s not ideal for active traders or those who frequently invest in US stocks.

Wealthsimple actually provides a really solid lineup of registered and non-registered accounts, covering most needs for long-term Canadian investors, whether they prefer a hands-off robo-advisor (Wealthsimple Invest) or a self-directed approach (Wealthsimple Trade).

Here’s a breakdown of the account types available on each platform:

Wealthsimple does not currently offer RDSP (Registered Disability Savings Plan) accounts, but has confirmed to evaluate adding them.1

Related read: Investment account types in Canada

Wealthsimple robo advisor (managed investing) pros and cons

Pros

-

Beginner-friendly: Fully managed portfolios with automatic rebalancing and dividend reinvestment.

-

No minimum deposit: Start investing with as little as $1.

-

Easy tax-efficient investing: Tax-loss harvesting and automatic RRSP/TFSA contributions.

-

Socially Responsible and halal investing: Options to align investments with ethical or religious values.

-

Hands-off approach: Great for investors who don’t want to manage their own portfolio.

-

Strong security and investor protection: CIPF insurance, 2FA and bank-grade encryption.

Cons

-

Limited control: Investors can’t pick individual stocks or customize asset allocations.

-

Higher fees than some competitors: 0.4%-0.5% management fee, while some robo-advisors offer 0.3%-0.4%.

-

No crypto exposure: Unlike Wealthsimple's self-directed accounts, you can’t invest in crypto with Wealthsimple Invest.

-

Not ideal for active investors: No ability to adjust investments beyond risk settings.

-

Slower withdrawals: It can take a few business days to move funds out of Wealthsimple Invest.

-

Portfolio performance has lagged competitors: Some users report lower returns compared to other robo-advisors.

Wealthsimple Trade (self-directed investing) pros and cons

Pros

-

Zero commission fees: Buy and sell stocks and ETFs without paying trading fees.

-

Fractional shares available: Invest in big companies such as Tesla or Amazon with as little as $1.

-

Supports RRSP, TFSA, FHSA and margin accounts: Great for tax-efficient investing.

-

Integrated crypto trading: Supports Bitcoin, Ethereum, and 50+ other cryptocurrencies.

-

Easy-to-use mobile app: Clean and simple interface for first-time investors.

-

New margin accounts available: Borrow money to invest and increase purchasing power.

Cons

-

1.5% currency conversion fee on US stocks: Can get expensive without a USD account ($10/month).

-

No advanced trading tools: No options trading, short selling or advanced charting tools.

-

No RESP support: Not ideal for those saving for a child’s education.

-

Crypto trading fees: 1%-2% spread on each trade, which is higher than Binance or Coinbase.

-

Slow deposits and withdrawals: Standard deposits can take 3-5 business days unless using instant deposits.

-

No in-depth research tools: No fundamental analysis or stock screening tools like Questrade or Interactive Brokers.

TL; DR

Wealthsimple Trade is best for self-directed investors looking for zero-fee trading and simplicity, while Wealthsimple Invest is better for hands-off, long-term investors who want automated wealth-building. Each has its trade-offs, but the right choice depends on how involved you want to be in managing your portfolio.

Wealthsimple fees and commissions

Wealthsimple robo-advisor

Wealthsimple Invest charges an annual management fee based on your total assets under management (AUM). These fees cover automatic portfolio rebalancing, dividend reinvestment and access to financial advice for Premium and Generation clients.

Hidden fees for Wealthsimple Invest

- 1.

ETF MERs apply: Wealthsimple Invest portfolios consist of ETFs with an additional 0.12%–0.42% MER, charged by the ETF providers

- 2.

Foreign exchange fees: While Wealthsimple Invest does not support direct USD holdings, international ETFs may be subject to FX conversion costs

Wealthsimple self-directed

Wealthsimple Trade is commission-free, meaning you can buy and sell Canadian stocks and ETFs at no cost. However, there are fees for US trades, instant withdrawals and premium features like margin trading.

Platform look and feel

I thought I'd buy some Tesla stock to show you how Wealthsimple's investment app looks on a mobile device. Here are my screenshots and how easy it is to buy stocks in Canada.

I've "greened" out my personal details and used a green outline to show you what I'm clicking on and what will appear on the next screen.

Wealthsimple portfolios

Wealthsimple offers five different portfolio options, each tailored to different investment styles and risk tolerances.

Whether you're looking for low-risk, income-focused investments (Conservative), a balanced approach, or high-growth potential, there's a portfolio suited for you. Additionally, Socially Responsible Investing (SRI) and halal portfolios cater to ethical and faith-based investors.

Which portfolio should you choose?

- If you prefer stability and minimal risk, the Conservative portfolio is your best bet.

- If you want a mix of safety and growth, the Balanced portfolio offers the best of both worlds.

- If you can tolerate volatility for higher long-term returns, go with the Growth portfolio.

- If sustainability and ethics matter to you, the SRI portfolio aligns with socially responsible investing.

- If you need a portfolio that follows Islamic finance principles, the Halal portfolio is a great fit.

Still not sure which one? Head over to our investing page where you'll find a risk assessment quiz.

Each Wealthsimple portfolio is designed to match different risk levels and investment goals, making it easy to find one that aligns with your financial strategy.

Wealthsimple focuses on accessible financial education rather than in-depth market research tools. It’s great for beginner investors but lacks the advanced stock screeners, technical analysis and fundamental data that active traders might need.

Wealthsimple Invest users don’t have any research tools since their portfolios are managed automatically. Wealthsimple Trade users get basic stock insights like price alerts and company profiles, but no advanced analytics.

| Feature | Wealthsimple robo advisor | Wealthsimple self-directed investing |

|---|---|---|

| Stock and ETF research | ❌ No | Basic company profiles, key stats |

| Advanced charting tools | ❌ No | ❌ No |

| Real-time market data | ❌ No | ✅ Yes |

| Price alerts | ❌ No | ✅ Yes |

| Fundamental analysis | ❌ No | ❌ No |

| Technical indicators | ❌ No | ❌ No |

| Stock screener | ❌ No | ❌ No |

| Visit site | Invest on auto-pilot | Direct your investments |

Wealthsimple Trade offers just enough for casual investors, but if you want in-depth market research, you’ll need platforms like TradingView or Questrade.

Wealthsimple’s educational content

Wealthsimple’s educational resources are well-structured and easy to digest.

- Wealthsimple Magazine: Articles on investing, taxes, and personal finance written in a way that’s actually interesting to read. Wealthsimple Magazine.

- Personal Finance 101 Learning Hub: A beginner-friendly blog covering investing, saving, and taxes. Wealthsimple Learning Hub.

- TLDR Newsletter: A quick-read email sent every Monday with market updates and financial tips (my personal favourite).

- Wealthsimple Podcast (Money Diaries): Real-life money stories with useful financial lessons.

- Webinars: Live sessions on investing, tax strategies and financial planning.

Financial planning tools

Wealthsimple provides several useful calculators to help investors plan better:

- Tax calculator

- RRSP calculator

- TFSA calculator

- Retirement calculator

- Fee calculator

These tools make it easy to estimate taxes, compare investment costs, and plan for retirement.

Webinars and live Q&As

Wealthsimple regularly hosts webinars covering topics like:

- Managing risk and protecting your portfolio

- Tax-efficient investing strategies

- Market trends and portfolio strategy

- Private equity and credit updates

Webinars often include Q&A sessions where investors can get their questions answered by experts.

Wealthsimple’s customer support is easy to reach, but response times depend on your account tier. Premium and Generation clients get priority service, while Core users may experience slightly longer wait times. That said, they offer multiple ways to get help, including phone, email, live chat and a virtual assistant.

How to contact Wealthsimple support

- Phone support: Available seven days a week. Wait times are typically two to three minutes, with a callback option if needed.

- Email support: Response times vary, but Premium and Generation clients receive priority email service.

- Live chat: Available through the Wealthsimple website or app, offering real-time assistance from support agents.

- Virtual assistant (chatbot): Can help with basic inquiries before escalating to human support.

- Help centre: A 24/7 self-service knowledge base with FAQs and guides.

For urgent matters, phone or live chat is the fastest option, while email works better for non-urgent issues. The chatbot is useful for quick questions, but you’ll need to escalate to a real person for complex problems.

Premium and Generation clients get faster responses via email and phone, making it easier to resolve issues quickly.

Financial advisors and 1:1 appointments

Wealthsimple gives all users access to one-on-one financial advisors, which is a great perk for investors who need personalized guidance.

- Advisor appointments: If you’re unsure about portfolio choices, tax strategies, or using your FHSA for a first home purchase, you can book a free call with a Wealthsimple advisor.

- Fiduciary advisors: They are legally required to act in your best interest.

- Available to all users: Unlike some platforms that limit advisors to high-net-worth clients, Wealthsimple allows anyone to book a session.

- Canada-based: Advisors understand local investing rules and tax considerations.

This feature makes Wealthsimple stand out, as many platforms charge extra for personalized investment advice.

What users say about Wealthsimple’s support

Reviews are generally positive, but response times can vary depending on the account tier.

- Phone support: Quick, usually under five minutes.

- Email support: Slower for Core users, but Premium and Generation clients get priority responses.

- Live chat: Useful for quick questions, but some users report long wait times during peak hours.

- Chatbot: Good for FAQs, but limited in handling complex issues.

Overall, Premium and Generation clients get a smoother support experience, while Core users may experience occasional delays. The advisor access is a huge plus, especially for investors looking for free, professional financial guidance.

Wealthsimple promotions

Wealthsimple is currently running a limited-time promotion called The Big Winter Bundle2, offering cash bonuses and lift tickets for qualifying account transfers and referrals.

Wealthsimple offer

Wealthsimple bonus details:

- 2% cash bonus on RRSP, Spousal RRSP, and LIRA account transfers

- 1% cash bonus on all other qualifying account transfers

- Minimum transfer amount: $15,000

- Cash deposits are NOT eligible: Only account transfers qualify

- You have 30 days to initiate the transfer after registering

and don't forget the bonus lift tickets (up to five available)

Wealthsimple is also offering up to five ski lift tickets through the Canadian Lift Pass program if you complete any of the following:

- One lift ticket for setting up a new direct deposit of at least $2,000 into your Wealthsimple Cash account (must be maintained for 6 months).

- Up to three lift tickets for referring a friend who opens and funds a new Wealthsimple account within 30 days.

- One lift ticket for transferring $15,000 or more into Wealthsimple, with at least one transfer being an RRSP or LIRA.

These lift tickets can be used at over 50 ski resorts across Canada, including popular destinations such as Big White, Blue Mountain and Marmot Basin. Once eligible, you can claim your ticket through the Wealthsimple app and book your preferred resort date via the Canadian Lift Pass website.

This promo is a great way to earn extra perks while transferring your investments — especially if you're moving RRSPs before the contribution deadline. As with all promotions, terms and conditions apply, so be sure to read the fine print before initiating a transfer.

What I like (and don’t) about Wealthsimple

I’ve used Wealthsimple for over five years, and in that time, I’ve seen the platform evolve, improve and expand. What stands out the most is how easy it is to use.

From setting up an account to funding it, investing and tracking performance, everything is seamless. Compared to the clunky interfaces of big banks, Wealthsimple feels modern and intuitive. Plus, no trading commissions on Canadian stocks and ETFs is a huge perk, especially for casual investors who don’t want to get eaten alive by fees.

Another thing I appreciate is how transparent Wealthsimple is. The fee structure is simple — no hidden charges or surprise deductions. Customer support is also solid. Every time I’ve reached out, I’ve felt like they actually want to help, not just push me toward a product upgrade.

In saying all of that though, Wealthsimple is not perfect.

The lack of advanced research tools in Wealthsimple Trade can be frustrating if you’re a more hands-on investor, and the 1.5% FX fee on US trades adds up quickly unless you pay for Trade Plus.

But if you’re looking for a simple, beginner-friendly investing experience, Wealthsimple is easily one of the best trading platforms in Canada.

Wealthsimple compared

Wealthsimple vs Questrade

- Lower FX fees

- advanced research tools

- free ETF purchases

- USD accounts

- RESP and margin accounts

Wealthsimple has commission-free Canadian stock/ETF trades (but Questrade now offers this too) and is easier for beginners, but Questrade is better for active traders and US stock investors.

Questrade is best for DIY investors who want research tools and low FX fees.

For a full breakdown, check out Wealthsimple vs. Questrade

Wealthsimple vs Qtrade

- Strong research tools

- Portfolio-building features

- Full range of investments (GICs, bonds, mutual funds)

Wealthsimple is cheaper (free trading) and more beginner-friendly, but Qtrade offers more investment options and deeper research.

Qtrade is best for Long-term investors who need full-service features

Wealthsimple vs Moomoo Financial Canada

- Zero-commission trading

- Advanced technical analysis

- Real-time market data

- Options trading

Wealthsimple is better for passive investors, but Moomoo dominates for active traders and those who need charting and research tools.

Moomoo is best for active traders who want real-time data and technical analysis

Wealthsimple vs TD Direct Investing

- Full-service brokerage

- Advanced research

- Mutual funds

- In-person branch support

Wealthsimple is much cheaper (no commissions), but TD offers more investment options and bank integration.

TD DI is best for investors who want a full-service brokerage and access to TD advisors

Wealthsimple vs Interactive Brokers

- Ultra-low fees

- Global market access

- Algorithmic trading

- Advanced execution

Wealthsimple is simpler for beginners, but IBKR is unmatched for serious traders and professionals. IBKR is best for professional traders who need global access and low-cost execution

Final thoughts

If you’re a Canadian looking to start investing but aren’t sure where to begin, Wealthsimple is a solid option to consider.

Related: How to invest money

Even if you’re already investing elsewhere but want a simpler, more transparent and modern way to manage your portfolio, Wealthsimple is definitely worth a test drive.

But remember, it's always important to do your own research before making any financial decisions. While this review covers Wealthsimple’s features, benefits and drawbacks in detail, every investor’s situation is unique — so take the time to assess your financial goals, risk tolerance and investment strategy before jumping in.

FAQs

Wealthsimple is one of the world’s leading robo-advisors, with offices in Canada, the USA, and Europe. The company was founded by CEO Michael Katchen in 2014, whose goal was to “bring smarter financial services to everybody, regardless of age or net worth.” Before starting Wealthsimple, Katchen worked at a Silicon Valley start-up and dispensed DIY investing advice to his colleagues.

With headquarters in Toronto, Wealthsimple is well-equipped to manage your money. They employ a team of world-class financial experts and the best technology talent. Their software engineers, designers, and data scientists have previously worked at esteemed companies such as Amazon, Google, and Apple. Today, Wealthsimple has over 1,000 employees and more than $50 billion in assets under management, making them the largest robo-advisor in Canada.

In short: they know what they’re doing with your money and they have a legal fiduciary duty to their clients.

Wealthsimple managed investing

Setting up an account and monitoring how the account is doing is incredibly easy even for a complete newbie (whether that be a newbie to investing or digital financial services) thanks to the user-friendly website and the fact that you don’t have to set up your own portfolio. You simply connect your account, set your risk profile, choose your portfolio and your done. We recommend to set up automatic contributions to let your money grow on auto-pilot.

Wealthsimple self-directed investing

Following the same streamlined and engaging website design as Wealthsimple managed investing, Wealthsimple self-directed investing is easy to join and buying and selling stocks is a straightforward process.

You don't need any experience with investing to start using Wealthsimple self-directed investing, however, if you are new to investing it can be very overwhelming to decide what stocks to buy and sell since there is little in-depth equity information on the site.

Who should use Wealthsimple managed investing?

Wealthsimple managed investing is restricted to passive robo-investing and as such is ideal for new investors who are intimidated by investing and would rather take a hands-off approach and let someone else manage their portfolio. However, despite being ideal for new and inexperienced investors, Wealthsimple managed investing is also good for experienced investors who just don’t have the time or inclination to manage their own investments.

Though suitable for inexperienced investors, it is completely online with no brick-and-mortar offices. It would not be a good fit for a person who isn’t comfortable with an online-only interface and who needs and enjoys meeting with an investor face to face.

Who should use Wealthsimple self-directed investing?

While it’s certainly easy to set up an account to start investing, getting the most out of Wealthsimple self-directed investing does require some experience with investing. You have to be comfortable buying and selling stocks with no supervision and advice. Wealthsimple self-directed investing is a better match for investors who don’t need a lot of hand-holding and who feel comfortable and have the time to manage their own portfolios.

Despite not being necessarily an ideal fit for new investors, the fact that there are no commission fees does make Wealthsimple self-directed investing a good option for those who have at least a basic knowledge of the stock market and are ready to give interactive investing a try.

Plus, self-directed investing will reimburse an outgoing administrative transfer fee of up to $150 on investment account transfers valued at more than $5,000.

When it was launched in 2019, Wealthsimple Trade made waves as Canada’s first commission-free trading platform. The platform has been through a few tweaks since its inception (the addition of a desktop-based version and a pay-per-month premium account option, for example) and today, lives under the refreshed title of self-directed investing, but overall remains a no-frills, user-friendly investing option.

How to buy stock with Wealthsimple self-directed investing

Wealthsimple managed investing is for self-directed investors. It’s a platform that investors can use to buy and sell stocks and ETFs, similar to what’s offered by other brokerages in Canada. All you have to do is download the app onto your phone or tablet or access the platform via your desktop computer.

Once you've linked your bank account, set your risk profile, it's recommended to set up automatic contributions and simply watch your money grow

One thing to note: if there’s a hot stock that you might want to buy, make sure you have enough money in your trading account, as it can take up to three days to transfer money from your linked bank account to your Wealthsimple self-directed account.

How to buy stock using Wealthsimple Trade (self-directed investing)

Follow these steps and you’ll be off to the races.

Step 1: Log in to Wealthsimple managed investing

Open the Wealthsimple app or log into your Wealthsimple account via your desktop. (Note that the visuals may be slightly different depending on whether you’re trading via the app or the website — though overall the appearance is quite similar).

Make sure to pick “Trade & Crypto,” not “Invest and Save!” The latter will take you to the Wealthsimple robo- advisor.

If you don’t have an account, it only takes a few minutes to sign up. Plus, Wealthsimple managed investing will reimburse an outgoing administrative transfer fee of up to $150 on investment account transfers valued at more than $5,000.

Step 2: Fund your account

If you don’t have any money in the account, you need to add funds before you can start trading.

Start by hitting “Add funds.”

Then enter the amount of money you want to deposit.

Then, wait for your deposit to arrive in your account. It usually takes about 30 seconds.

Depending on how much you deposit into your account, some funds might be available instantly, while the rest might take between 3–5 business days before you can begin trading. You can instantly deposit $1,500 with a free account, and $5,000 if you are a Plus subscriber ($10/month).

Once the money hits your account, you can start trading. You can also set up regular auto deposits so you’re never without funds.

Step 3: Search for stocks

Now the fun part: shopping for stocks!

In the app, hit the Browse Stocks button or use the search bar at the top right corner of your screen to search stocks and ETFs. You’ll be taken to a screen that features a list of stocks ranked by activity and performance.

You’ll also find other headings, including crypto (if you wanted to buy any crypto, you need to open a Wealthsimple Crypto account), biotechnology stocks, newly listed stocks and more.

Another option is to simply tap on the heading to get a more detailed list of stocks from the specified category.

For example, let’s say I want to buy one share of Air Canada stock. I could either hit Air Canada from the Top 100 screen or start typing the stock symbol or company name in the search bar.

Step 4: Read the stock chart

Next, you want to check out all the info about a stock or ETF.

Using Air Canada as the example again, I tap AC and then details about the stock are displayed. That includes information about:

- What exchange the stock is sold on

- The highest the stock has traded for in the last 52 weeks

- The market cap (the total number of outstanding shares multiplied by share price).

Note that there is a 15-minute delay for the data. You would need to get a premium Wealthsimple managed investing account to get to the second stock data.

Step 5: Select the stock

If you decide you want to buy the stock, you just hit “Buy.” You will then be asked how many units of the stock you want to buy. Select the amount and hit continue.

Note that the price of the stock and the cost to buy it are the same because Wealthsimple managed investing does not charge a fee. (However, if I had wanted to buy a U.S. stock, Wealthsimple managed investing charges a 1.5% currency conversion fee on Canadian to US dollar conversions.)

Step 6: Confirm the purchase

You’ll then be asked to confirm the purchase.

Your order will then be sent.

Step 7: Pour yourself a drink. You’re done!

You will get an email to confirm that your order has been filled.

How to sell stocks on Wealthsimple managed investing

Selling stocks on Wealthsimple managed investing is just as easy and intuitive as buying them.

Step 1: Select the stock you want to trade

Login to your account and go to the dashboard, where you can see what stocks you hold and how they’ve been doing. For this example, I only have this one share of Air Canada stock that I can sell.

Step 2: Tap the stock you want to trade

Go to the portfolio section, which is about halfway down your dashboard landing page. Just tap the stock symbol.

Step 3: Select “sell”

Once you tap the stock symbol (in this case, AC), Wealthsimple managed investing will take you to a new screen that asks you if you want to buy or sell the stock. Simply hit “sell."

Step 4: Select number of stocks to sell

Wealthsimple will show you the number of shares you have and how many are available for sale. They will also show you the sell price per share.

Step 5: Confirm the sale

Simply hit “Continue” once you’ve selected the number of stocks to sell.

You’ll then be asked to confirm the sale. You’ll also be shown how much it will cost you to make the trade. Of course, because Wealthsimple managed investing is commission-free, there is no charge to sell the stock.

Step 6: Order sent. You’re done!

That’s it! You have sold your first stock (hopefully not at a loss!).

Wealthsimple will also send you an email to confirm that your order has been filled. Best of all, if you’ve made a mistake and want to rebuy the stock, you can do so easily and without paying a trading fee.

Wealthsimple uses the Nobel Prize-winning Modern Portfolio Theory to design their portfolios. This theory gained fame in the 1950s when Harry Markowitz figured out that it was the best way to manage your money over the long term. The Modern Portfolio Theory determined that a passive investing approach to the market (that is, assembling a portfolio that minimizes volatility by diversifying) is a proven and reliable way to grow your money over a long period of time.

Wealthsimple puts this theory to work by designing portfolios that use low-cost ETFs to track the market as a whole. This strategy minimizes the risk to your money by eliminating the volatility of individual stocks and taking advantage of winners by investing in a lot of stocks at once – optimizing your investment returns.

Portfolio options

Wealthsimple has three primary portfolio options:

- Conservative: This portfolio is heavily weighted toward low-volatility bonds, with 62.5% of its holdings in government bonds, high-yield bonds, and short-term bonds. Designed for investors who prefer stability and a modest return. The conservative portfolio has a five-year annualized return of 5.34%.

- Balanced: This portfolio has a 50/50 ratio between bonds and equities. Suitable for investors with low-to-medium risk tolerance. The balanced portfolio has a five-year annualized return of 6.10%.

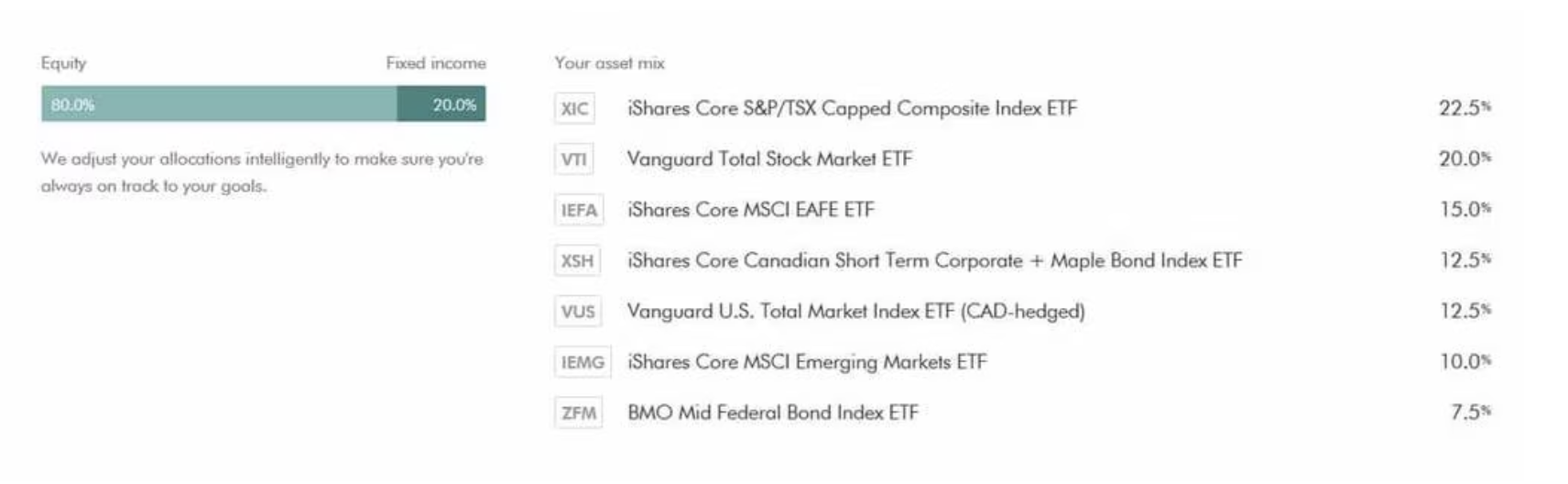

- Growth: This portfolio is strongly weighted towards stocks, with up to 80% of its holdings in emerging markets, foreign stocks, Canadian stocks, US stocks, International stocks, and Emerging Market stocks. Designed for an investor with medium-to-high risk tolerance. The growth portfolio has a five-year annualized return of 8.18%.

During sign-up, you’ll be asked to complete a questionnaire designed to match you with one of their three portfolios. These portfolios each have an asset allocation designed to suit your risk tolerance and time horizon and are built with ETFs. This lets Wealthsimple build a very diverse portfolio without the costs of constantly buying, selling, and re-balancing.

Asset classes

Each of the Wealthsimple portfolios includes nine ETFs, with each ETF representing a unique asset class. Here are the ETFs that Wealthsimple uses to construct your portfolio:

Wealthsimple has a sleek, user-friendly platform that provides all the details needed to make an informed decision about your investments. While some robo-advisors provide reams of financial information, Wealthsimple keeps the info overload to a minimum. There are only four options to choose from on the main menu, and only two of those deliver information about their products and services. Once you click on the “get started” option, you’re funnelled through the classic robo-advisor questionnaire designed to assess your needs, your time horizon and your risk tolerance. It’s that simple.

Wealthsimple claims to have the easiest and fastest sign-up process of all Canadian robo-advisors, clocking in at just five minutes. We went through the sign-up process and tested the portfolio-matching process.

Right off the bat, you need to create an account with a username and password. Then you’ll need to provide standard information like your employment details, address and social insurance number. This part takes about three minutes.

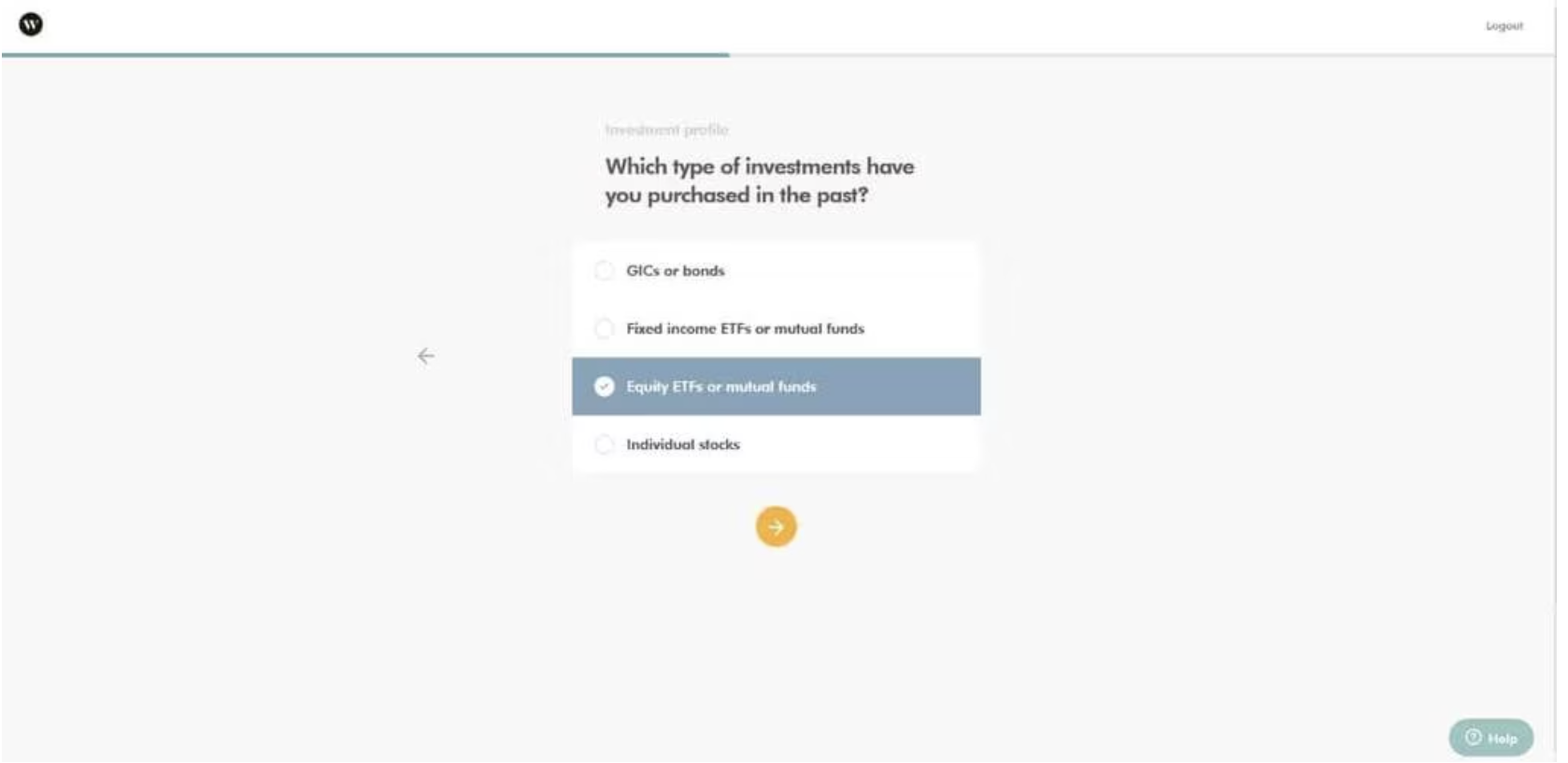

Once the basic information is covered, it’s time to go through the process of choosing your investments. Wealthsimple asks you the basic questions we expect of every robo-advisor, including questions about what investments you’ve purchased in the past.

Completing the questionnaire, Wealthsimple did show us which portfolio works: their “Growth” portfolio.

At this point, you can choose to make your portfolio socially responsible if you didn’t select that option in the questionnaire. We love that this screen shows projected Wealthsimple performance over time, but if you click on the “our assumptions” link they clearly state that past performance does not guarantee future results – essentially the opposite of the sales pitch you’d receive in a financial advisor’s office.

Next, we wanted to see where they were planning to invest the funds before pulling the trigger to sign up. Fortunately, that information was available farther down on the screen.

Next, opening an account: we were prompted to select which accounts we wanted to open. We had the option to open all of the standard accounts expected including savings accounts, TFSAs, and RRSPs.

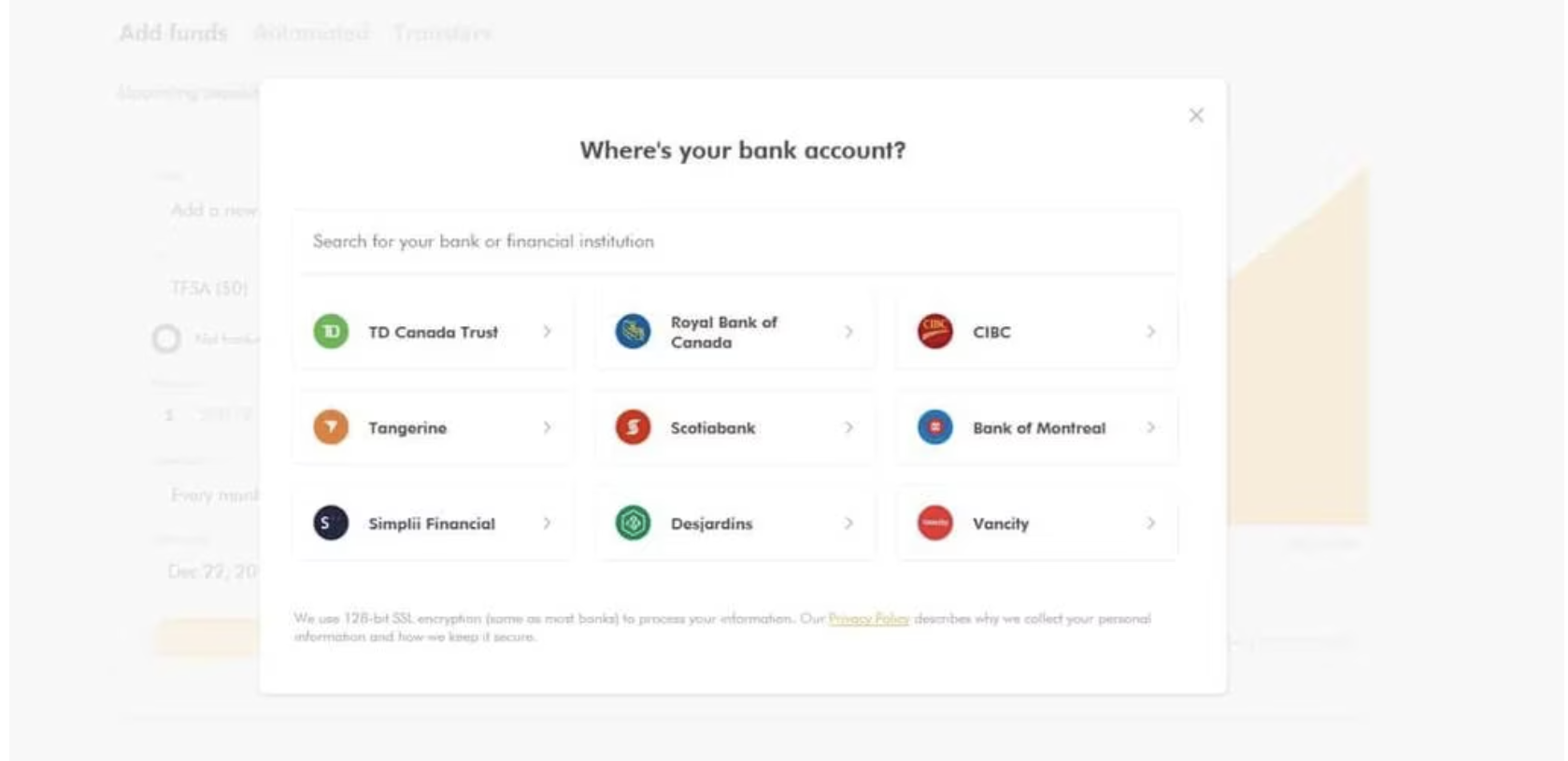

This stage of the account opening process is where some robo-advisors get a little dicey and confusing because sometimes linking bank accounts is an annoying process that requires submitting paperwork. With Wealthsimple, linking a bank account was surprisingly easy.

From there, it’s just a matter of setting up your automatic deposits, and you’re off to the races.

From our testing, it took less than 15 minutes to open a Wealthsimple account – much faster than lengthy meetings with a financial advisor. Plus, we found that the process of linking your Wealthsimple account to an external bank account was surprisingly easy. Here’s what’s needed to sign up:

- Your name, date of birth, and social insurance number

- Your email address

- Your phone number and address

- The login information for your online banking

The process of signing up is simple:

- Fill out an online application.

- Verify and connect a bank account by securely authenticating your online banking.

- You’re done! Your account should be set up in less than 5 business days.

Editor’s note: Please see Wealthsimple via our Apply Now button for latest details.

With files from Sandra MacGregor and Lisa Jackson

Noel Moffatt is a Canadian fintech expert with a passion for simplifying personal finance. Based in St. John’s, NL, he draws on his background in finance, SEO, and writing to deliver clear explanations and actionable advice. Noel is dedicated to equipping readers with the knowledge and tools they need to make informed financial decisions, striving to make personal finance more accessible and understandable through his in-depth articles and reviews.

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Best investing content

How to...

More platform reviews

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.