Key takeaways

-

- Questrade announced that it will now offer commission-free stock and ETF trades, joining Wealthsimple Trade and National Bank Direct Brokerage as Canada's third 0% commission broker.

- Questrade is a leading Canadian discount brokerage offering various account types with a minimum deposit of $1,000.

- The platform features user-friendly trading interfaces suitable for both novice and active traders, with tools such as Questrade Edge and QuestMobile designed to meet different trading needs

Questrade has long been a top choice for DIY investors, now offering commission-free stock and ETF trades while still providing low fees and pro-level trading tools.

But with its clunky mobile app and occasional customer service complaints, is the trade-off still worth it?

On the flip side, robo-advisors strip away the complexity, making investing seamless and stress-free. Yet, convenience often comes at a cost — higher fees, limited account options and less control.

So, the question becomes: Do you value cost savings and flexibility, or do you prefer simplicity and automation? The answer depends on what kind of investor you want to be.

Visit QuestradeWho is Questrade best for?

Questrade is a prime choice for Canadian investors seeking low fees, commission-free trading, flexibility and a robust trading platform, free from the limitations of big bank brokerages. It suits the following types of investors:

- DIY investors: Ideal for those who prefer to manage their own investment portfolios and execute individual stock or ETF trades.

- ETF enthusiasts: Perfect for investors looking to construct a cost-effective ETF portfolio with the perk of commission-free trading.

- Dividend investors: Great for investors aiming to buy and hold dividend-paying stocks while cutting down on trading costs.

- Active traders: Suited for investors who trade often and can leverage Questrade’s sophisticated tools and pricing for active traders.

- USD investors: Fits anyone trading US stocks who prefers to avoid hefty currency conversion fees by maintaining USD in registered accounts.

- Cost-conscious investors: Attractive for those seeking a budget-friendly alternative to traditional bank brokerages, devoid of account maintenance or inactivity fees.

- New investors with growth in mind: Optimal for beginners desiring a scalable platform that supports starting small and gradually expanding their portfolio.

Questrade provides an extensive array of both registered and non-registered accounts, tailored to diverse investment strategies:

Registered accounts

- TFSA (Tax-Free Savings Account): Enables tax-free interest, gains and withdrawals for achieving both short- and long-term financial objectives. Unused contribution room rolls over annually.

- RRSP (Registered Retirement Savings Plan): Supports tax-deferred growth, with contributions reducing taxable income. Can also be tapped for purchasing a first home (HBP) or funding education (LLP).

- RESP (Registered Education Savings Plan): Aids in setting aside funds for a child's higher education, complemented by government grants and tax advantages.

- FHSA (First Home Savings Account): Dedicated to saving for a first home purchase, offering tax-free growth and tax-deductible contributions.

- Spousal RRSP: Facilitates income splitting between spouses in retirement, enhancing tax efficiency.

- Locked-In RRSP (LIRA): Holds pension funds transferred from a previous employer, subject to withdrawal restrictions.

- LIF (Life Income Fund): Transforms a LIRA into a source of retirement income, with set withdrawal boundaries.

- RRIF (Registered Retirement Income Fund): Allows retirees to draw a taxable income from their accumulated RRSPs while preserving tax-deferred growth.

Non registered accounts

- Individual and joint margin accounts: Provides the ability to borrow for investments, offering leverage and short-selling capabilities.

- Individual and joint cash accounts: Basic non-registered accounts for trading stocks, ETFs and other securities.

- Corporate margin and cash accounts: Designed for business investments.

- Forex and CFDs accounts: Open to both individuals and corporations for trading in foreign exchange and contracts for difference.

- Trust and partnership accounts: Accommodates informal and formal trusts, partnerships and sole proprietorships.

Accounts not supported by Questrade

- RDSP (Registered Disability Savings Plan): Intended for long-term savings for individuals with disabilities, supported by government grants and bonds.

- Group RRSPs: Retirement savings plans sponsored by employers.

- Defined Benefit or Defined Contribution Pension Plans: Pension funds managed by employers.

So while Questrade obviously supports a broad range of investment accounts, it currently does not offer RDSPs (neither does Wealthsimple) or employer-managed group pension plans.

Questrade pros and cons

Pros

-

Low trading fees: As of February 2025, Questraade now offers zero-commission trading.

-

No annual or inactivity fees: No maintenance fees on RRSPs, TFSAs or non-registered accounts.

-

Commission-free ETF transactions: Great for passive investors building an ETF portfolio.

-

Supports USD in RRSPs and TFSAs: Avoids costly currency conversion fees when trading US stocks.

-

Strong research and data tools: Access to TipRanks, Morningstar and customizable trading platforms.

-

Diverse account options: Supports TFSA, RRSP, RESP, FHSA, corporate accounts, margin trading and forex.

-

Active trader pricing: Discounted trading fees available for high-volume traders.

-

Questwealth portfolios available: Offers a robo-advisor option for those who prefer automated investing.

Cons

-

No free mutual fund purchases: Mutual fund trades cost $9.95 per transaction.

-

$1,000 minimum to start trading: You need at least $1,000 deposited to place your first trade.

-

Mobile app needs improvement: Low user ratings (2.1/5 on Google Play, 1.7/5 on Apple Store) due to delays and glitches.

-

Customer service can be slow: Long wait times for phone and chat support reported by users.

-

ECN fees on some trades: Electronic communication network fees can add costs, especially for high-frequency traders.

-

No RDSP support: Doesn’t offer Registered Disability Savings Plans, unlike some competitors.

-

Limited free research: More advanced market data requires paid subscriptions.

-1740431547.png)

Questrade keeps things cheap and transparent when it comes to self-directed investing. Low trading commissions, no annual fees on most accounts and a cost-efficient structure make it one of the best deals out there for DIY investors.

For the average trader, the standard pricing is already solid. But if you’re really into active trading, Questrade Edge gives you access to advanced tools and even lower fees — especially if you sign up for a market data subscription. More features, better pricing and still way cheaper than the big banks? It's hard to complain.

Below is a breakdown of Questrade’s fees, including trading commissions, hidden fees and forex costs.

Hidden fees to watch out for

Questrade is known for keeping trading costs low, but like always, there are still some admin fees you should know about.

Management fees (Questwealth portfolios)

If you’re go with Questwealth Portfolios, Questrade’s robo-advisor service, here’s what you’ll pay:

- 0.25% on accounts up to $100K

- 0.20% on accounts over $100K

- ETF MERs range from 0.17% to 0.22% (or 0.21% to 0.35% for socially responsible portfolios)

Questwealth is one of the cheapest robo-advisors in Canada, but remember, it does have a $1,000 minimum deposit to get started.

Commission on forex trades

Questrade allows trading of currency pairs with spreads as low as 0.08 pips. There are no commissions, but traders should consider:

- Leverage options for forex and CFDs (contract for differences)

- Dual-currency accounts to avoid constant conversion fees

- ECN and liquidity provider fees may apply when placing large trades

Navigating the Questrade app

The Questrade mobile app is sleek, intuitive and functional, designed to offer a smooth trading experience for both beginners and active traders.

1. Account overview

- The home screen provides a snapshot of your portfolio, including total equity, cash balance, market value and buying power.

- You can toggle between different currencies (CDN/USD) and track your open and realized profit/loss (P&L).

- A simple navigation menu at the bottom offers quick access to buy/sell options, money transfers, transaction history and account documents.

2. Trading dashboard

- The trading screen displays real-time stock quotes, trending tickers and the latest price movements for your watchlist.

- Stocks that are among the "Most Active" symbols are highlighted, helping traders spot high-volume opportunities.

- Clicking on a stock opens detailed price charts, key statistics and buy/sell buttons for quick trading.

3. Placing an order

- The order placement interface is streamlined yet powerful. Users can choose between:

- Limit orders: Set a custom price for buying/selling.

- Market orders: Execute instantly at the current market price.

- Advanced orders: Includes bracket orders, stop-loss and conditional trades.

- You can place orders based on:

- Share quantity: Specify how many shares you want to buy.

- Dollar amount: Enter a total dollar amount, and the system calculates the maximum number of whole shares you can buy.

4. Order review and execution

- Before submitting, Questrade provides a review screen displaying the order details, estimated total cost and applicable trading fees.

- Extended-hours trading availability is also highlighted, allowing traders to participate in pre-market and after-hours sessions.

- Once confirmed, the order is placed, and you can track execution in real-time within the Positions tab.

Here’s a breakdown of what the Questrade app looks like inside:

On the left is your home page to give you a quick glimpse of how your portfolio is performing. In the middle is the margin account dashboard and on the right is the type of quick hit information you can get on a stock.

Here's what it looks like to buy a stock with Questrade. You an set a market or limit order, decide if you want to buy a number of shares or a spend a specific dollar amount and then it'll take you to a confirmation screen.

Questwealth Portfolios is Questrade’s take on the robo-advisor game and honestly? It’s a solid choice if you’re looking for a low-cost, hands-off investing solution.

You’ll get matched to one of five ETF-based portfolios — Aggressive, Growth, Balanced, Income or Conservative — depending on your risk tolerance and financial goals.

Related action: check out our risk tolerance assessment quiz on our investing home page.

If you’re big on ethical investing, they’ve even got Socially Responsible Investing (SRI) portfolios, which focus on companies that prioritize ESG (Environmental, Social and Governance) principles.

Now, what makes Questwealth stand out from other robo-advisors? Unlike the usual “set-it-and-forget-it” robo platforms that just track the market with passive index funds, Questwealth actually uses actively managed ETFs. In theory, this gives you a better shot at long-term gains, while still keeping fees low.

Speaking of fees, Questwealth is one of the cheapest robo-advisors in Canada. The management fee is 0.25% for accounts under $100K and drops to 0.20% if you’re rolling with six figures. ETF MERs range from 0.17% to 0.22% (or up to 0.35% if you go the SRI route). Compared to mutual funds, it’s a steal.

But there’s a catch — Questwealth requires a $1,000 minimum deposit to get started. And that’s actually quite a bit of a barrier compared to Wealthsimple, which lets you start with whatever spare change you have lying around.

Read our Questwealth portfolio review which sits within our top robo advisors in Canada.

If you’re trading US stocks or buying US-listed ETFs, you don’t want to be paying Questrade’s 1.5% currency conversion fee every time you move money between CDN and USD.

Enter Norbert’s Gambit — a sneaky but totally legal trick to convert your money for as little as $5 to $10 per transaction instead.

Here’s how it works:

- 1.

Buy DLR.TO (the CND version of an interlisted ETF).

- 2.

Journal it over to DLR.U.TO (the USD version).

- 3.

Sell it in US dollars — boom, your CDN is now USD at almost the exact exchange rate.

Sounds great, right? The catch is that it takes three to four business days to settle, so it’s not ideal if you need an instant conversion. But, if you’re moving $1,000+ or regularly trading US stocks, this can save you hundreds over time.

Questrade is one of the best platforms for this since it allows dual-currency accounts, meaning your funds stay in USD instead of being auto-converted back to CDN (which some brokerages force on you). If you don’t mind the wait, Norbert’s Gambit is hands-down the cheapest way to flip your money between CDN and USD without getting gouged on fees.

Customer service can make or break a trading platform. Questrade is ranked #1 among discount brokerages for a reason.

They’ve made big improvements to response times, the account setup process is ridiculously easy via the mobile app, and you can reach them through email or online chat.

However, Questrade’s customer service has areas for improvement. Some customers report long wait times for online chat and slow email response times, with some inquiries going unreturned1. Many customers have expressed frustration with the long wait times for phone support, with some reporting waits of up to several hours.

Another downside is that some transactions must be done over the phone, meaning you’re stuck in the queue whether you like it or not. It’s a bit of a pain, especially for traders who prefer to do everything online.

That being said, Questrade is working on stepping up its customer service game. They’re actively improving response times and refining support, so hopefully, it only gets better from here.

Questrade’s Dividend Reinvestment Plan (DRIP) is an awesome feature if you’re looking to grow your portfolio automatically.

Instead of getting cash payouts from dividends, your earnings are instantly used to buy more shares of eligible stocks or ETFs.

This means your investments keep compounding over time — without you having to lift a finger. It’s a set-it-and-forget-it strategy that works great for long-term investors who want steady, passive growth.

Setting up a Questrade DRIP? Really easy.

You just fill out a Purchase Authorization Form, decide whether you want all eligible securities or just a few select ones enrolled, and send it over via email or upload it to your Questrade account.

There are no commissions or fees on reinvested dividends, and in some cases, you can even scoop up fractional shares, making sure every last cent is put to work. If you ever want out, canceling is just as easy — no need to sell your shares, just send in a request and boom, you’re done.

If you’re in it for long-term wealth-building and don’t need dividend payouts for income, DRIP is a no-brainer. But if you prefer to reinvest dividends manually or use the cash for other investments, you can always opt out and take the payouts instead. Either way, it’s a solid tool to have in your investing strategy.

What I like (and don’t) about Questrade

I love Questrade because it actually feels like a real investing platform — polished, professional and built for people who take their money seriously. You get everything you need: low fees, commission-free trading, margin accounts (now also offered by Wealthsimple), USD holdings and solid research tools.

Unlike some of the more flashy investing apps that feel like they’re trying too hard to be cool, Questrade gives off major "I know what I’m doing" energy. If you’re a DIY investor looking for a powerful (but still cost-effective) alternative to the big-bank brokerages, it checks almost every box.

Now, in saying all of that, Questrade can sometimes feel a little too buttoned-up at times — especially if you’re just starting out. One thing I really appreciate about Wealthsimple Trade is that it makes investing stupidly easy. The layout is clean, the app is beginner-friendly and you don’t feel like you need a finance degree just to buy your first stock.

Meanwhile, Questrade assumes you already know what you’re doing — and if you don’t, well, good luck. And let’s not forget that $1,000 minimum deposit to start trading that we talked about above.

Wealthsimple? No minimum required.

So if you’re just dipping your toes into the world of investing, that alone might be enough to push you toward a platform that doesn’t make you feel like you need to read an investing textbook before signing up.

Questrade compared

Questrade vs Wealthsimple Trade

- Wealthsimple is best for beginners and passive investors

Wealthsimple Trade is the go-to if you want zero-commission trading and fractional shares — perfect for beginners or anyone looking to get started without paying fees on every trade. But, if you're an active trader, into US stocks or want advanced research tools, Questrade takes the edge.

Need more? Read Questrade vs Wealthsimple

Questrade vs Qtrade

- Long-term investors who need full-service features

Qtrade is solid with its research tools and a full range of investments, but Questrade wins when it comes to keeping costs down. Lower trading fees, free ETF transactions and better USD account options make it a better choice for cost-conscious investors.

Need more? Read Questrade vs Qtrade

Questrade vs Interactive Brokers (IBKR)

- Active traders and professionals who need low-cost, global trading

Interactive Brokers is king when it comes to ultra-low fees, global market access and pro-level trading tools. But, if you're not a hardcore trader, Questrade is easier to use, doesn’t charge inactivity fees and is just a better fit for the average investor.

Questrade vs. TD Direct Investing

- Investors who prefer in-person support and banking integration

TD Direct Investing is great if you want everything under one roof — banking and investing all in one place, plus full-service support. But if saving money on fees is your priority, Questrade is the way to go with free ETF transactions and lower trading costs for DIY investors.

The final verdict

Questrade shines as the go-to for DIY investors, delivering a fine mix of low fees, robust research tools and versatile account options.

Go to QuestradeFor those looking for comprehensive services, Qtrade offers a dependable choice while Interactive Brokers caters well to the serious trader, while TD Direct Investing is perfect for those who prefer the familiarity and extensive resources of a major bank.

FAQ

Dive deeper into Questrade

If you’re an active trader, you can also gain access to one of several market data plans that Questrade offers. For a monthly fee, you can get active trader pricing, live streaming data, and other data add-ons. This is perfect for active traders. Here are your options:

- 1.

Basic (Free with all accounts): This is great for novice traders, and you’ll get free Canadian level 1 snap quotes, free U.S. level 1 snap quotes, and one-click real-time data.

- 2.

Enhanced ($19.95/month CAD): you’ll get everything that comes with Basic, plus enhanced level 1 live streaming data, live streaming for Intraday Trader, and additional data add-ons. In addition, if you spend more than $48.95 in trading commissions you’ll get an automatic $19.95 rebate.

- 3.

Advanced ($89.95/month CAD): This package is for the most active traders. You get active trader pricing unlocked, advanced Canadian level 1 and level 2 live streaming data, select U.S. level 1 live streaming data, and individual data add-ons are available. You can earn a partial rebate if you spend more than $48.95 in commissions — for this, you’ll get an automatic rebate of $19.95. If you spend more than $399.95 in trading commissions, your monthly fee is automatically rebated.

If you sign up for the Advanced plan noted above, you will unlock active trader pricing. This gives you low fees on trading so you can trade as much as you want without having to worry about breaking the bank. There are two plans to choose from once you unlock this feature:

No annual fees:

- Some online brokerages charge a fee between $50-100 per year to “maintain” your RRSP or TFSA, especially for balances under $15,000. Questrade charges no annual fees and no inactivity fees. This is a perk for smaller investors since a $100 annual fee on a smaller account (say $10,000) is equal to a 1% fee – which essentially negates any savings you’d accrue by going the DIY route.

Commission free bonds and GICs:

- Your portfolio will likely contain a mix of stocks along with less volatile assets like bonds and GICs. Questrade charges a spread that is built into the price of the bond and varies depending on the individual bond. There is a minimum purchase amount of $5,000 to buy bonds. Trading GICs at Questrade is commission-free, but the minimum order is $5,000 (some GICs may have higher minimums).

Holding USD in Questrade’s RRSP or TFSA:

- A big bonus is you can hold USD in your registered accounts, which means you don’t have to do the dreaded currency conversion if you have USD to invest. You can also convert your CAD into USD with their currency converter too to save money on foreign exchange fees. Avoiding needless currency conversion fees is another way to keep your money working for you!

Paid transfer fees:

- When switching to Questrade, some financial institutions may charge you a transfer fee. Don’t sweat it – Questrade will reimburse transfer fees up to $150 per account. This is a good deal considering transfer out fees can be hefty at most places.

IPO centre:

- Questrade allows you to purchase Initial Public Offerings (IPOs) for FREE (no commissions) with a minimum purchase of $5,000. IPO occurs when a private company goes public (offers shares on a stock exchange) for the first time. Questrade has an IPO Centre where you can review the most recent IPOs, sign up for the IPO Bulletin, and buy IPOs by filling out an online form.

Instant deposit:

You can instantly deposit up to $3500 into your Questrade account and start trading immediately. That means you’ll never miss out on a trading opportunity!

Refer a friend program:

- Tell your friends about Questrade and get $25 for every friend who opens an account. Get a $50 bonus for every third referral.

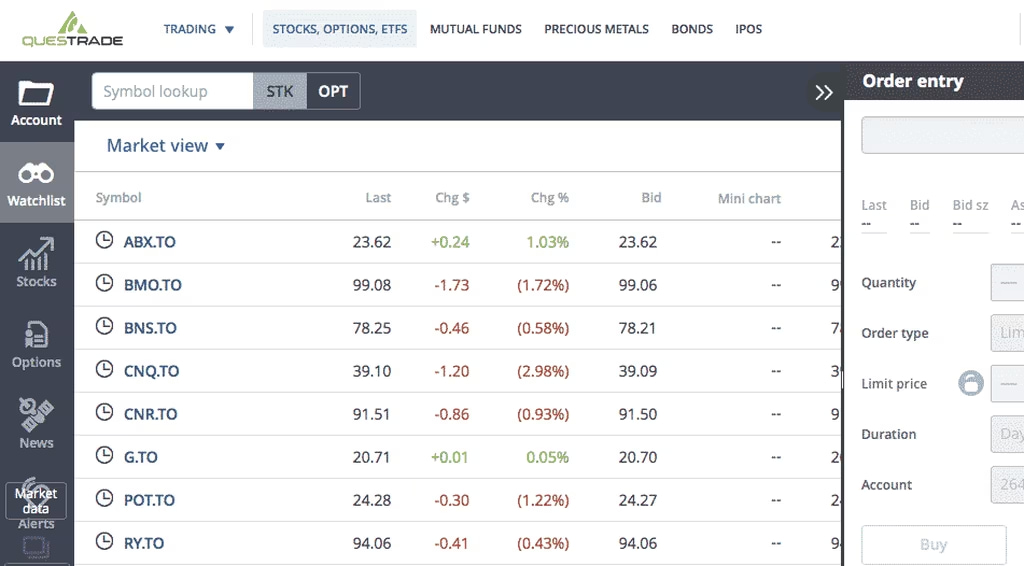

Before you dive into Questrade yourself, here is an inside look at Questrade’s platform, these are older screenshots, but just gives you an idea. The screenshot below shows the watch list and the order entry to buy shares.

Here’s another example of what a watch list might look like with the Questrade trading platform. I like the colours since the red and green help you discern/ visualize how the stocks that you are watching are doing more easily. If you’re wondering what a watchlist is, the basic idea is that if you pick stocks, you might want to keep your eye on how your “targets” are doing at any specific time. This allows you to quickly pull up a screen and see if there have been any movements in the companies that you are interested in.

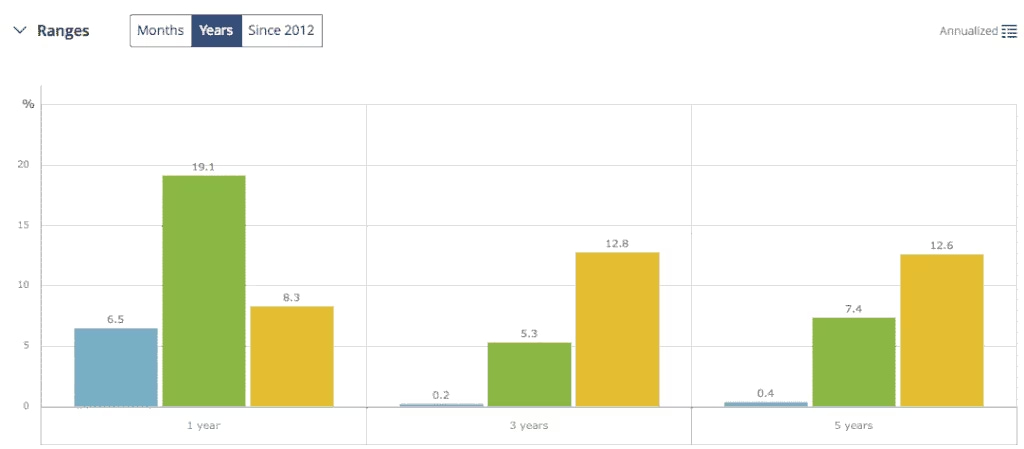

Here’s what Questrade’s investment return page looks like in the chart format, it’s an easy way to analyze your portfolio’s performance.

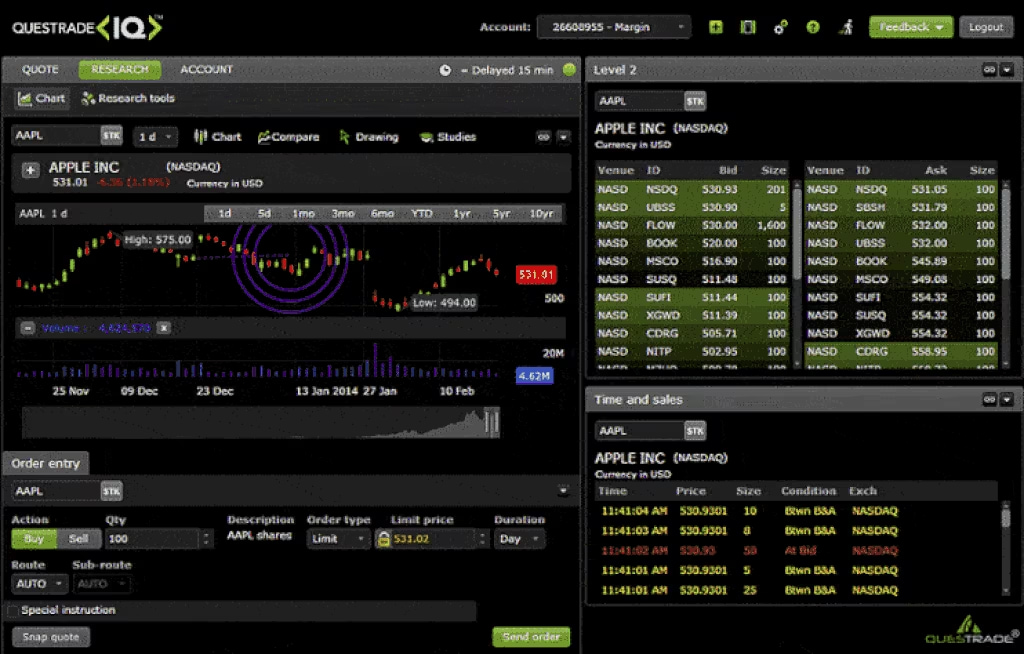

IQ Edge

Another platform that Questrade has is called IQ Edge. This platform is suitable for investors looking to trade in higher volumes (not couch potato investors) and has a darker, more intense layout. IQ Edge is much more customizable and lets you adjust the settings to accommodate your personal needs.

It also has a pre-installed option trading layout, and IQ Edge gives you the ability to make advanced trading orders, such as conditional orders and multi-leg options strategies. IQ Edge is highly customizable and created for advanced day traders (not my style).

Here’s a screenshot of what IQ Edge looks like, as you can see it’s much more detailed compared to the regular Questrade Platform and is complete with advanced trading tools:

IQ Web Platform

Questrade also has a third platform to choose from called IQ Web Platform. This platform allows you to add customizable gadgets that are easily accessible when you log in. Here is a screenshot of a margin account on IQ Web.

For the vast majority of DIY investors who are using ETFs to build passive investing portfolios, you won’t need IQ Web or IQ Edge. Just stick to the basic trading platform, and you’ll be just fine.

For the more sophisticated trader, Questrade offers a platform to trade currencies, commodities, and global stock CFDs (contracts for difference). With Questrade FX Global, investors can access global markets through more than 15 international exchanges and trade over 110 currency pairs. Questrade Global mobile is available for Apple and Android devices.

You may have never heard of a stock CFD, but it works much like an ETF that tracks an index. In this case, the stock CFD tracks the performance of a stock. The advantage of CFDs is they can give you exposure to international companies at a lower cost than owning international stocks directly.

It’s important to understand that trading CFDs is extremely risky and investors can lose money quickly due to the use of leverage. An estimated two-thirds of retail accounts lose money trading CFDs.

Questrade is one of the only full-service brokers that allows investors to trade forex. It offers competitive pricing with target spreads as low as 0.8 pips. The “spread” is the difference between the bid price that someone is willing to pay and the ask price that someone is willing to sell at.

Why would you want to trade forex? It’s the world’s largest financial market with more than $4 trillion exchanged each day. Markets are open 24 hours and have a low barrier to entry, meaning even beginner investors can get into forex trading. Trading currency pairs seems highly intuitive – we’ve all at some point closely monitored exchange rates such as CAD-to-USD or USD-to-EUR. If you believe one currency will rise or fall versus its trading pair then you would place a trade making that bet.

Questrade Global is packed with research tools and insights designed to keep you on top of the securities that interest you the most. Best of all, the account is free – meaning there’s no annual fee, and no opening or closing fees.

The best feature Questrade offers here is its 30-day risk-free practice account, where investors get $100,000 CAD in virtual cash to try their hand at trading forex and CFDs. When you’re ready to move from a practice account to the real deal, simply open either an Individual Forex & CFD account or a Joint Forex & CFD account.

With an individual account, you’ll get access to global markets and can trade 24 hours a day. A joint account gives you all the advantages of an individual account, plus allows you to pool investments with a group of two or three investors for a bigger stake in the market. There’s also the potential for corporate, partnership, informal and formal trusts, investment clubs, and sole proprietorship accounts.

If you’re the type of investor who wants to engage in forex trading – and we’re not suggesting that you are – then you should ask yourself if Questrade is the right platform for this activity. The top competitor to Questrade in the forex broker space is Interactive Brokers.

Interactive Brokers offers a similar number of currency pairs (105) along with more than 7,400 CFDs across global markets. The biggest difference between Questrade and Interactive Brokers is that while Questrade offers competitive spreads as low as 0.8%, Interactive Brokers doesn’t publish its average forex spread and instead charges a trading commission of between $16 to $40 per trade. Active traders may be entitled to lower pricing based on their trading volume.

Interactive Brokers is highly rated for advanced forex traders, but the downside is there’s no practice account feature to test out the platform – you’re immediately thrown to the wolves to fend for yourself.

Questrade’s practice account sets it apart from Interactive Brokers and will give beginners an edge to get their heads wrapped around forex trading before putting their real money on the line.

Questrade is as safe as any other brokerage. The company is a registered investment dealer and a member of the Investment Industry Regulatory Organization of Canada (IIROC). They’re also a member of the Canadian Investor Protection Fund (CIPF), a not-for-profit insurance program. These Canadian regulatory organizations oversee Questrade’s operations and ensure that they adhere to strict investment industry standards.

The company also takes your security seriously: Questrade has numerous technology and infrastructure installed to protect your money. Your account is encrypted and securely stored, and you will receive an alert if there’s suspicious activity in your account. With security measures such as PIN numbers and Touch/Face ID, you can feel assured that only you can access your account. They also care about your privacy: Questrade promises to never sell, trade or share your information with anyone.

Above all, Questrade promises 100% reimbursement for any unauthorized transactions in your Questrade account that result in direct losses to you, and your account is insured for up to $10 million in the event that Questrade becomes insolvent.

How to sign-up with Questrade

Signing up for Questrade is a cinch. If you’re ready to sign up with Questrade, a few documents are needed. The entire process of Questrade is done online, and you’ll only need the following to get going:

- Your email address

- Your Questrade login and password

- Your full name and home address

- Your social insurance number

- Employment information

- Your phone number

- Government-issued photo ID (and the ability to either take a picture of it or scan it)

Once you’ve opened an account, the last step is to transfer funds from your bank into your Questrade account.

Take me to Questrade

Noel Moffatt is a Canadian fintech expert with a passion for simplifying personal finance. Based in St. John’s, NL, he draws on his background in finance, SEO, and writing to deliver clear explanations and actionable advice. Noel is dedicated to equipping readers with the knowledge and tools they need to make informed financial decisions, striving to make personal finance more accessible and understandable through his in-depth articles and reviews.

Jordann Brown is a freelance personal finance writer whose areas of expertise include debt management, homeownership and budgeting. She is based in Halifax and has written for publications including The Globe and Mail, Toronto Star, and CBC.

Best investing content

How to...

More platform reviews

Disclaimer

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.